XYZ Inc is preparing an income summary for the year ended December 31, 2018, and below are the revenue and expense account balances as of December 31, 2018. Permanent accounts are accounts that show the long-standing financial position of a company. These accounts carry forward their balances throughout multiple accounting periods. Finally, you are ready to close the income summary account and transfer the funds to the retained earnings account. Income summary is a holding account used to aggregate all income accounts except for dividend expenses.

AccountingTools

A hundred dollars in revenue this year doesn’t count as $100 in revenue for next year even if the company retained the funds for use in the next 12 months. After this entry is made, all temporary accounts, including the income summary account, should have a zero balance. Notice the balance in Income Summary matches the net income calculated on the Income Statement. We know that all revenue and expense accounts have been closed. If we had not used the Income Summary account, we would not have this figure to check, ensuring that we are on the right path.

Closing journal entries example

It will be done by debiting the revenue accounts and crediting the income summary account. After passing this entry, all revenue accounts will become zero. An income summary is a temporary account in which all the revenue and expenses accounts’ closing entries are netted at the accounting period’s end. Once the entries are finalized, the income summary closing entries are documented and transferred to the retained earnings of an organization or individual. Closing entries are entries used to shift balances from temporary to permanent accounts at the end of an accounting period. These journal entries condense your accounts so you can determine your retained earnings, or the amount your business has after paying expenses and dividends.

- Transferring funds from temporary to permanent accounts also updates your small business retained earnings account.

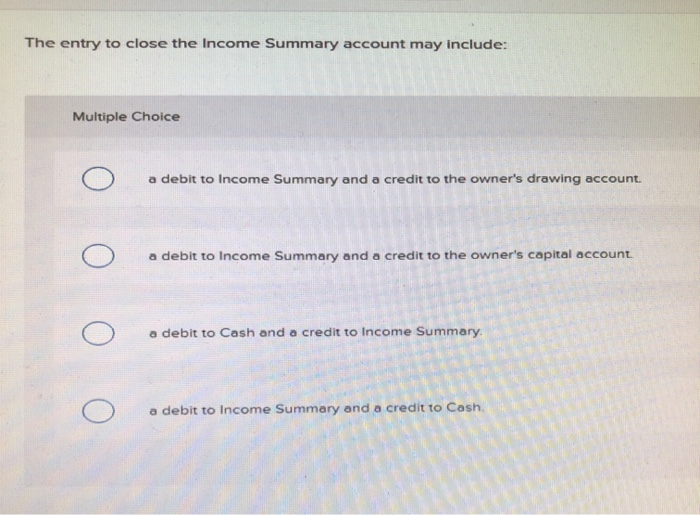

- In such cases, one must close the owner’s income summary account to their capital account.

- To close expenses, we simply credit the expense accounts and debit Income Summary.

- For partnerships, each partners’ capital account will be credited based on the agreement of the partnership (for example, 50% to Partner A, 30% to B, and 20% to C).

Closing entries Closing procedure

To make them zero we want to decrease the balance or do the opposite. We will debit the revenue accounts and credit the Income Summary account. The credit to income summary should equal the total revenue from the income statement.

Despite the fact that both provide insights into the financial health of an organization or an individual, the former is a temporary account and the latter is a permanent account. Moreover, the entries in the income statement are finally transferred into the income summary after which, the deductions are made. Debit income summary for the balance contained in the income summary account. For instance, a company with a $5,000 credit in the income summary account must debit income summary for $5,000. This entry takes the income summary account balance off the company?s books.

Remember, modern computerized accounting systems go through this process in preparing financial statements, but the system does not actually create or post journal entries. The purpose of the closing entry is to reset temporary account balances to zero on the general ledger, the record-keeping system for a company’s financial data. This is closed by doing the opposite ? debit the capital account (decreasing the capital balance) and credit Income Summary.

After closing all the company’s or firm’s revenue and expense accounts, the income summary account’s balance will equal the company’s net income or loss for the particular period. In such cases, one must close the owner’s income summary account to their capital account. In a corporation’s case, one must close the retained earnings account.

At the end of the period, the company will need to make the closing entry for net income by transferring all revenues and expenses to the income summary account. Likewise, all revenue accounts and all expenses accounts will be closed by transferring all revenues and expenses to the income summary account. Closing entries are journal entries used to empty temporary accounts at the end of a reporting period and transfer their balances into permanent accounts. Temporary accounts are used to accumulate income statement activity during a reporting period. The use of closing entries resets the temporary accounts to begin accumulating new transactions in the next period.

The main change from an adjusted trial balance is revenues, expenses, and dividends are all zero and their balances have been rolled into retained earnings. We do not need to show accounts with zero balances on the trial balances. On the other hand, if the company makes a net loss, it can make the income summary journal entry by debiting retained earnings account and crediting the income summary account instead. An income summary is a summary of Income and expenses for a specific period, and the result of this summary is profit or loss. It works as a checkpoint and mitigates errors in preparing financial statements by directly transferring the balance from revenue and expense accounts. Income summary account is a temporary account used in the closing stage of the accounting cycle to compile all income and expense balances and determine net income or net loss for the period.

A company with $10,000 in the revenue account must credit income summary for $10,000 to close the revenue account. This entry transfers the revenue balance to the company?s income summary account. If you paid out dividends during the accounting period, you must close your dividend account. Now that the income summary account is closed, you can close ch09 profit planning your dividend account directly with your retained earnings account. Instead, the basic closing step is to access an option in the software to close the reporting period. Doing so automatically populates the retained earnings account for you, and prevents any further transactions from being recorded in the system for the period that has been closed.