To make the balance zero, debit the revenue account and credit the Income Summary account. You can either close these accounts directly to the retained earnings account or close them to the income summary account. If the net balance of the income summary is a credit balance, it means the company has made a profit for that year, or if the net balance is a debit balance, it means the company has made a loss for that year. It summarizes income and expenses arising from operating and non-operating activities.

Four Steps in Preparing Closing Entries

Below are the T accounts with the journal entries already posted. Any account listed on the balance sheet is a permanent account, barring paid dividends. On the balance sheet, $75 of cash held today is still valued at $75 next year, even if it is not spent. Let us understand the advantages of passing income summary closing entries for an organization or an individual through the points below. For partnerships, each partners’ capital account will be credited based on the agreement of the partnership (for example, 50% to Partner A, 30% to B, and 20% to C).

Closing Entry: What It Is and How to Record One

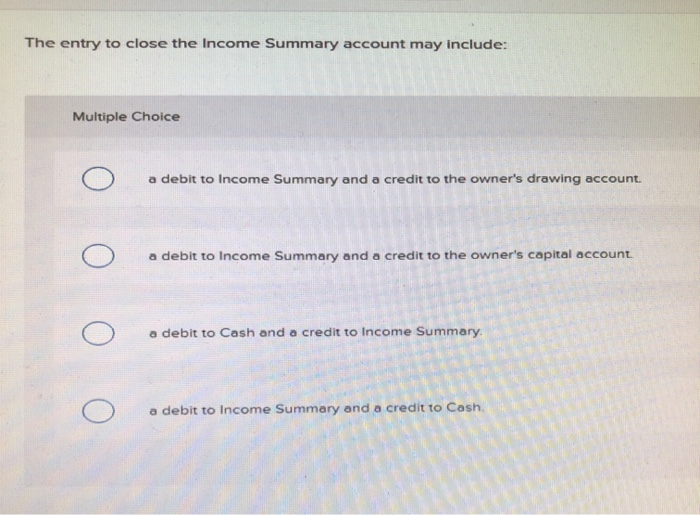

Then the income summary account is zeroed out and transfers its balance to the retained earnings (for corporations) or capital accounts (for partnerships). This transfers the income or loss from an income statement account to a balance sheet account. This is the only time that the income summary account is used. For the rest of the year, the income summary account maintains a zero balance. When doing closing entries, try to remember why you are doing them and connect them to the financial statements. To update the balance in Retained Earnings, we must transfer net income and dividends/distributions to the account.

Income Summary Journal Entry

Companies use closing entries to reset the balances of temporary accounts ? accounts that show balances over a single accounting period ? to zero. By doing so, the company moves these balances into permanent accounts on the balance sheet. These permanent accounts show a company?s long-standing financials.

Indicate the day and month when the company closes the expense account to the income summary. In addition, if the accounting system uses subledgers, it must close out each subledger for the month prior to closing the general ledger for the entire company. If the subsidiaries also use their own subledgers, then their subledgers must be closed out before the results of the subsidiaries can be transferred to the books of the parent company. Notice how only the balance in retained earnings has changed and it now matches what was reported as ending retained earnings in the statement of retained earnings and the balance sheet. It may be assumed that the income summary normal balance is on the credit side as this refers that the company expects the net income at the end of the period, in which it usually does expect that.

- Permanent accounts track activities that extend beyond the current accounting period.

- Debit income summary for the balance in the company?s expense account.

- Let us understand the disadvantages through the discussion below.

- If your revenues are less than your expenses, you must credit your income summary account and debit your retained earnings account.

- Our T-account for Retained Earnings now has the desired balance.

- These permanent accounts show a company?s long-standing financials.

How to create closing entries

Balances from temporary accounts are shifted to the income summary account first to leave an audit trail for accountants to follow. Permanent accounts track activities that extend beyond the current accounting period. They’re housed on the balance sheet, a section of financial statements that gives investors an indication of a company?s the best small business accounting software for 2021 value including its assets and liabilities. The trial balance above only has one revenue account, Landscaping Revenue. If the account has a $90,000 credit balance and we wanted to bring the balance to zero, what do we need to do to that account? In order to cancel out the credit balance, we would need to debit the account.

We now close the Distributions account to Retained Earnings. Distributions has a debit balance so we credit the account to close it. Our debit, reducing the balance in the account, is Retained Earnings. Despite the various advantages listed above, there are a few factors that act as hassles while maintaining an income summary account. Let us understand the disadvantages through the discussion below. Let us understand the concept of an income summary account with the help of a couple of examples.

The income summary is a temporary account where all the temporary accounts, such as revenues and expenses, are recorded. Instead of sending a single account balance, it summarizes all the ledger balances in one value. It transfers it to a balance sheet, which gives more meaningful output for investors, and management, vendors, and other stakeholder. An income summary account summarizes all the operating and non-operating business activities on one page and concludes the company’s financial performance. Write the date when the company transfers the income summary balance to the retained earnings account.

Creating closing entries is one of the last steps of the accounting cycle. At the end of the accounting period, all fees will be closed by transferring the debit to the income summary by crediting the expenses account and debiting the income summary account. After passing this entry, the all-expense accounts balance will become zero.

After the financial statements are finalized and you are 100 percent sure that all the adjustments are posted and everything is in balance, you create and post the closing entries. The closing entries are the last journal entries that get posted to the ledger. Income summary effectively collects NI for the period and distributes the amount to be retained into retained earnings.