An accounting transaction is a business activity or event that causes a measurable change in the accounting equation. Merely placing an order for goods is not a recordable transaction because no exchange has taken place. In the coming sections, you will learn more about the different kinds of financial statements accountants generate for businesses. A company’s quarterly and annual reports are basically derived directly from the accounting equations used in bookkeeping practices. These equations, entered in a business’s general ledger, will provide the material that eventually makes up the foundation of a business’s financial statements. This includes expense reports, cash flow and salary and company investments.

Great! The Financial Professional Will Get Back To You Soon.

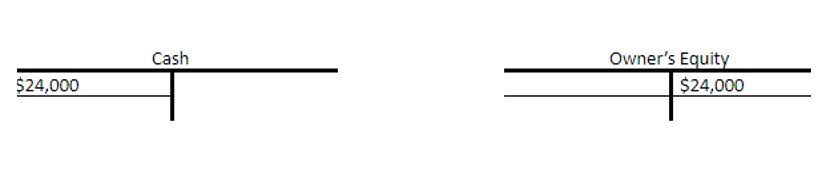

The accounting equation is so fundamental to accounting that it?s often the first concept the basic accounting equation may be expressed as taught in entry-level courses. It offers a quick, no-frills answer to keeping your assets versus liabilities in balance. Shareholders? equity is the total value of the company expressed in dollars.

Financial statements

An error in transaction analysis could result in incorrect financial statements. In fact, most businesses don?t rely on single-entry accounting because they need more than what single-entry can provide. Single-entry accounting only shows expenses and sales but doesn?t establish how those transactions work together to determine profitability. Notice that every transaction results in Food Truck Accounting an equal effect to assets and liabilities plus capital.

- We may earn a commission when you click on a link or make a purchase through the links on our site.

- It is based on the idea that each transaction has an equal effect.

- For every business, the sum of the rights to the properties is equal to the sum of properties owned.

- This straightforward relationship between assets, liabilities, and equity is considered to be the foundation of the double-entry accounting system.

- This arrangement can be ideal for sole proprietorships (usually unincorporated businesses owned by one person) in which there is no legal distinction between the owner and the business.

- As a result of the transaction, an asset in the form of merchandise increases, leading to an increase in the total assets.

To Ensure One Vote Per Person, Please Include the Following Info

- Although the balance sheet always balances out, the accounting equation can?t tell investors how well a company is performing.

- Someone on our team will connect you with a financial professional in our network holding the correct designation and expertise.

- These equations, entered in a business’s general ledger, will provide the material that eventually makes up the foundation of a business’s financial statements.

- That is, each entry made on the Debit side has a corresponding entry on the Credit side.

- Of course, this lead to the chance of human error, which is detrimental to a company?s health, balance sheets, and investor ability.

- On the other hand, double-entry accounting records transactions in a way that demonstrates how profitable a company is becoming.

Creditors have preferential rights over the assets of the business, and so it is appropriate to place liabilities before the capital or owner’s equity in the equation. These may include loans, accounts payable, mortgages, deferred revenues, bond issues, warranties, and accrued expenses. The accounting equation focuses on your balance sheet, which is a historical summary of your company, what you own, and what you owe. The effect of this transaction on the accounting equation is the same as that of loss by fire that occurred on January 20. As a result of the transaction, an asset in the form of merchandise increases, leading to an increase in the total assets. At this point, let’s consider another example and see how various transactions affect the amounts of the elements in the accounting equation.

Which of these is most important for your financial advisor to have?

Metro issued a check to Office Lux for $300 previously purchased supplies on account. Net value refers to the umbrella term that a company can keep after paying off all liabilities, also known as its book value. It specifically highlights the amount of ownership that the business owner(s) has.

- Almost all businesses use the double-entry accounting system because, truthfully, single-entry is outdated at this point.

- It specifically highlights the amount of ownership that the business owner(s) has.

- This statement reflects profits and losses that are themselves determined by the calculations that make up the basic accounting equation.

- Metro issued a check to Rent Commerce, Inc. for $1,800 to pay for office rent in advance for the months of February and March.

- Both liabilities and shareholders? equity represent how the assets of a company are financed.

At first glance, this may look overwhelming contra asset account ? but don?t worry because all three reveal the same information; it just depends on what kind of information you?re looking for. A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation. Someone on our team will connect you with a financial professional in our network holding the correct designation and expertise. Our goal is to deliver the most understandable and comprehensive explanations of financial topics using simple writing complemented by helpful graphics and animation videos. On 1 January 2016, Sam started a trading business called Sam Enterprises with an initial investment of $100,000.

Put another way, it is the amount that would remain if the company liquidated all of its assets and paid off all of its debts. The remainder is the shareholders? equity, which would be returned to them. In other words, the total amount of all assets will always equal the sum of liabilities and shareholders? equity. Essentially, the representation equates all uses of capital (assets) to all sources of capital, where debt capital leads to liabilities and equity capital leads to shareholders? equity.