In the manual accounting system, the company uses the income summary account to close the income statement at the end of the period. Once this process is complete, a post-closing trial balance is prepared which helps in preparation of the balance sheet. At the end of the accounting period, all the revenue accounts will be closed by transferring the credit balance to the income summary.

Understanding Closing Entries

Credit expenses for the amount contained in the company?s expense account. If a company has $5,000 in its expense account, the company must credit expense for $5,000. This entry transfers the expense account balance to the company?s income summary. If your revenues are less than your expenses, you must credit your income summary account and debit your retained earnings account.

- This entry takes the income summary account balance off the company?s books.

- Post the transactions to the income summary account and close the income summary account.

- If this is the case, then this temporary dividends account needs to be closed at the end of the period to the capital account, Retained Earnings.

- Just like in step 1, we will use Income Summary as the offset account but this time we will debit income summary.

- Remember the income statement is like a moving picture of a business, reporting revenues and expenses for a period of time (usually a year).

Using Income Summary in Closing Entries

All temporary accounts must be reset to zero at the end of the accounting period. To do this, their balances are emptied into the income summary account. The income summary account then transfers the net balance of all the temporary accounts to retained earnings, which is a permanent account on the balance sheet.

Permanent Versus Temporary Accounts

For example, the expenses are transferred to the debit side of the income summary while the revenues are transferred to the credit side of the income summary. The company can make the income summary journal entry by debiting the income summary account and crediting the retained earnings if the company makes a net income. Remember the income statement is like a moving picture of a business, reporting revenues and expenses for a period of time (usually a year). Likewise, shifting expenses out of the income statement requires you to credit all of the expense accounts for the total amount of expenses recorded in the period, and debit the income summary account. This is the first step to take in using the income summary account.

Step 1: Close all income accounts to Income Summary

These examples would give us an in-depth idea about the concept. Notice that the balance of the Income Summary account is actually the net income for the period. Remember that net income is equal to all income minus all expenses. We have completed the first two columns and now we have the final column which represents the closing (or archive) process. We?ll use a company called MacroAuto that creates and installs specialized exhaust systems for race cars. Here are MacroAuto?s accounting records simplified, using positive numbers for increases and negative numbers for decreases instead of debits and credits in order to save room and to get a higher-level view.

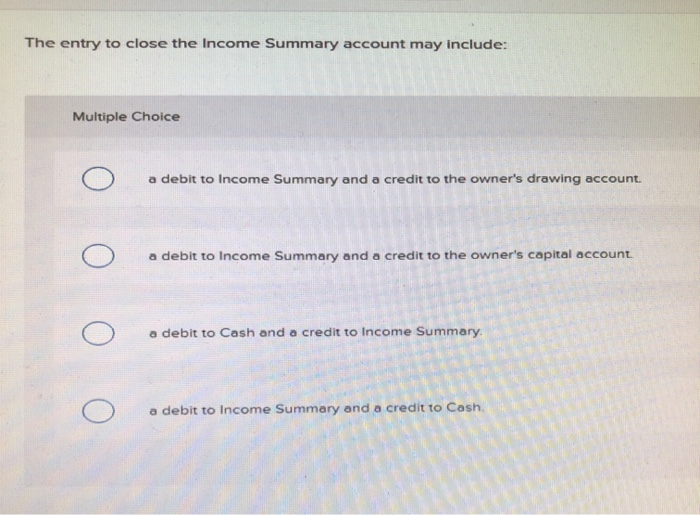

A closing entry is a journal entry that?s made at the end of the accounting period that a business elects to use. It?s not necessarily a process meant for the faint of heart because it involves identifying and moving numerous data from temporary to permanent accounts on the income statement. This can affect dividends and can be important to investors. The closing entry entails debiting income summary and crediting retained earnings when a company?s revenues are greater than its expenses. The income summary account must be credited and retained earnings reduced through a debit in the event of a loss for the period.

It is entirely possible that there will not even be a visible income summary account in the computer records. It is also possible that no income summary account will appear in the chart of accounts. After preparing the closing entries above, Service Revenue will now be zero. The expense accounts and withdrawal account will now also be zero. Credit retained earnings for the balance contained in the income summary account.

By closing revenue, expense and dividend/distribution accounts, we get the desired balance in Retained Earnings. Now that the revenue account is closed, next we close the expense accounts. You must close each account; you cannot just do an entry to ?expenses?. You can, however, close all the expense accounts in one entry. If the balances in the expense accounts are debits, how do you bring the balances to zero? The debit to income summary should agree to total expenses on the Income Statement.

An accounting period is any duration of time that’s covered by financial statements. It can be a calendar year for one business 9 best accounting software for ecommerce companies best ecommerce software while another business might use a fiscal quarter. A company shouldn’t bounce back and forth between timeframes.